manage complex regulations

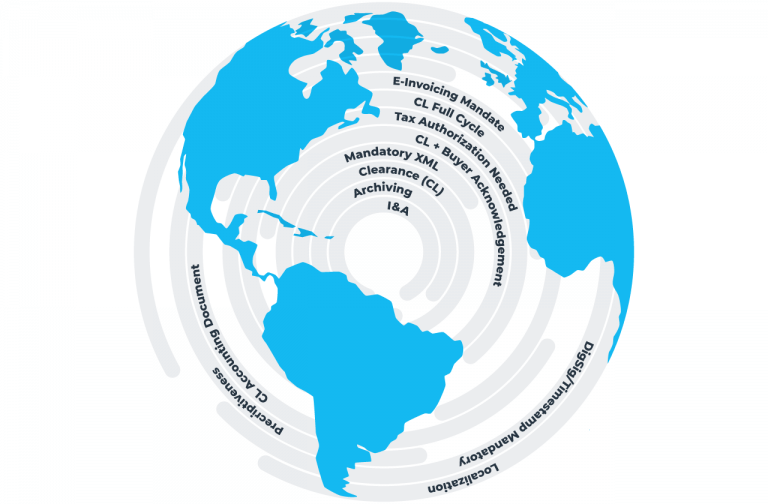

Ensuring e-invoicing compliance in more than 60 countries

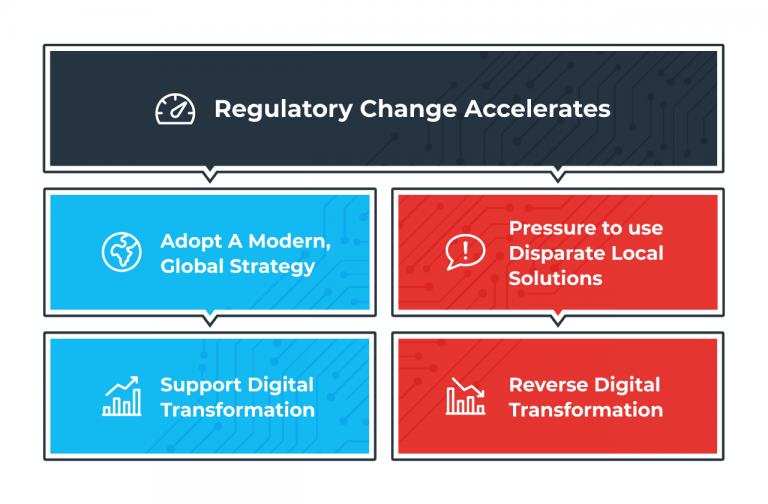

To help communities thrive, governments around the world are embracing e-invoicing controls designed to close the VAT gap, but every country writes its regulations differently. Because there are no global rules for enforcement, compliance is notoriously complex — especially for multinational companies.